What is the role of a responsible sourcing policy?

Analysis by Kumi of companies that are members of the Responsible Minerals Initiative has found that surprisingly few companies have responsible sourcing policies that are aligned with established industry good practice standards. Companies send critical signals to their supply chains through the policy commitments they make and, increasingly, will be exposed to compliance risks if their policies are inconsistent with regulatory expectations.

Clear commitments to responsible business conduct

The starting point for establishing robust management systems for responsible sourcing is to publish clear commitments to responsible business conduct. Policy documents must be developed that publicly commit a company to minimising the social and environmental impacts of its operations and supply chain.

Yet, at Kumi, we find across all the sectors we work in that companies often struggle at this first hurdle.

The World Benchmarking Alliance’s (WBA) Social Transformation Baseline Assessment 2022 found that few companies have the basic foundations in place to create positive impacts and sustainable outcomes. Out of the 1,000 companies assessed by the WBA, only 1% meet the majority of the WBA’s fundamental expectations such as committing to respect human rights and the rights of workers, promote decent workplaces and anti-corruption.

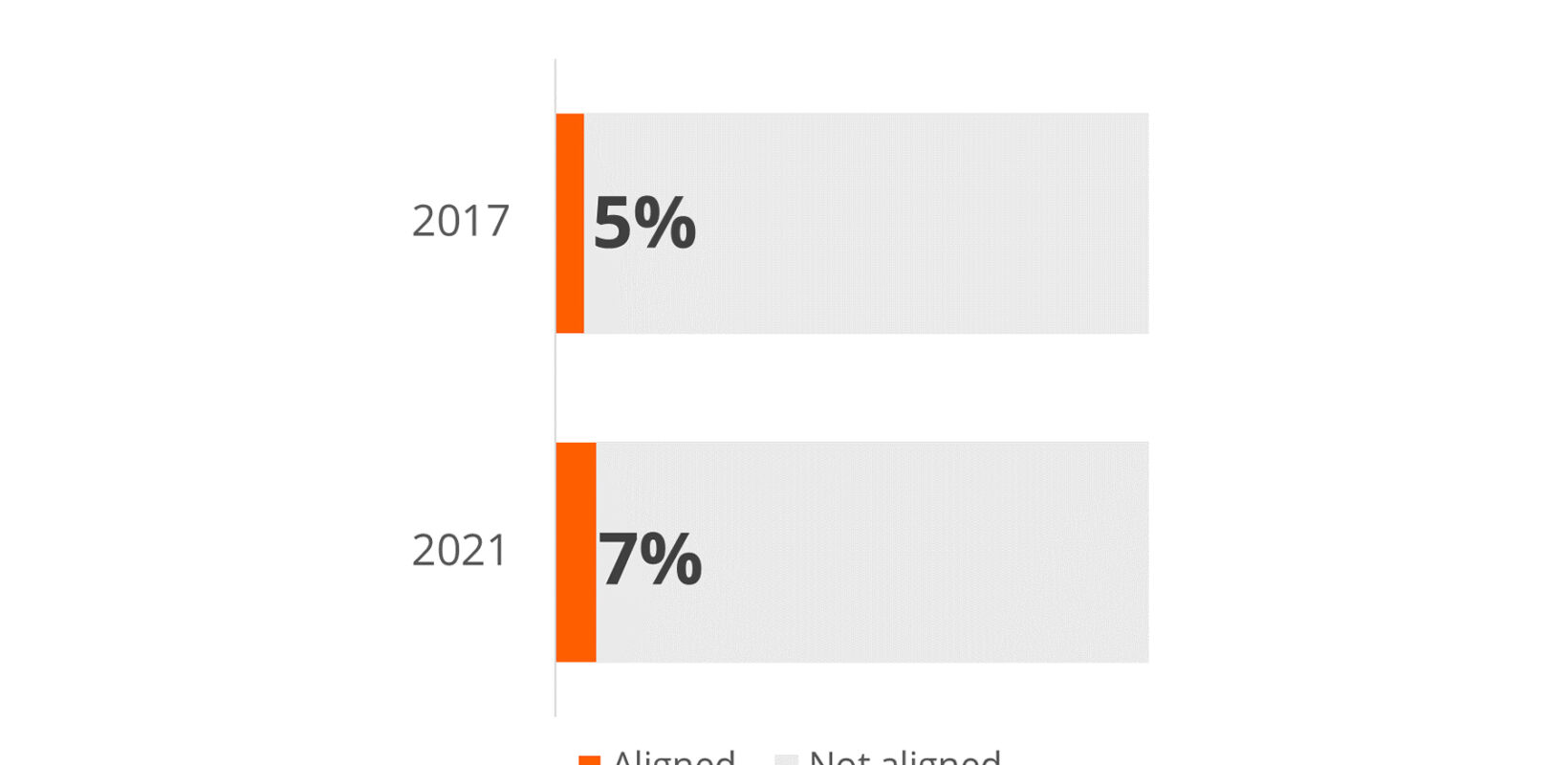

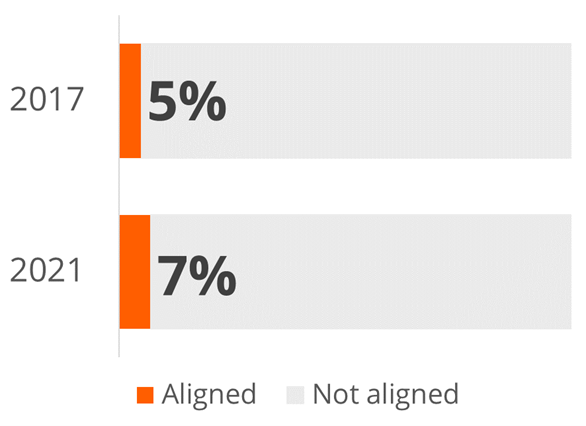

In 2017, we undertook an analysis of Responsible Minerals Initiative’s (RMI) members’ policies to understand how companies that had specific interests in and exposure to mineral and metal supply chains were applying international responsible sourcing expectations to their own business standards. We found that only 5% of the companies were aligned with good practice recommendations and set out in the OECD’s Due Diligence Guidance.

Little progress in alignment of companies’ responsible sourcing policies with good practice since 2017

Using the same criteria, we re-reviewed RMI member companies’ policies towards the end of 2021, looking at the responsible sourcing policies of 284 companies. Disappointingly, we found that there had been very little progress:

- Only 7% of all companies’ policies were aligned with good practice recommendations.

- Only 16% of the RMI members that are also Fortune 500 companies have policies that meet good practice recommendations.

- Technology and automotive companies comprise a large proportion of RMI members, but only 8% of the companies in both industries had policies that aligned with good practice recommendations.

Since the 2017 analysis, there has been significantly more focus on responsible sourcing in minerals supply chains, including the introduction of the EU Conflict Minerals Regulation and the LME Responsible Sourcing requirements. More broadly, responsible sourcing has become a cross-sectoral compliance concern with the arrival of several mandatory supply chain due diligence regulations in Europe. Yet, it appears that in terms of corporate policy-level commitments from major multinational businesses, virtually no progress has been made.

A comparison of the percentage of RMI member companies whose responsible minerals policies are aligned with good practice recommendations for responsible sourcing (2017 and 2021).

Responsible sourcing policy commitments set tone for ESG due diligence

A company’s responsible sourcing policy sets the tone for how the business engages with supply chain due diligence and manages environmental, social and governance (ESG) risks in its operations and amongst its suppliers. It forms the overarching narrative of how a company operates in relation to responsible sourcing.

If a policy is too narrow in its scope, this has material consequences down the supply chain, constraining the ESG due diligence that is undertaken at subsequent tiers of the supply chain.

As part of our advisory services for clients, at Kumi we frequently assess companies’ management systems for responsible sourcing. The majority of companies we evaluate have various policies in place for responsible business conduct, but we commonly find that these fall short of the full scope of the good practice recommendations developed by organisations such as the OECD.

Working for a large automotive brand, we recently assessed its suppliers’ approaches to the procurement of responsible minerals. We found that whilst many of the suppliers had systems in place for ESG due diligence, few of them had made policy commitments that were sufficient to align with the OECD’s recommendations.

For instance, a policy may mention the company’s commitment to eliminating human rights abuses, but other key risks may be omitted such as supporting illegal activities by security forces – a common issue in the minerals sector. Another common issue is that many companies with mineral supply chains continue to only focus on sourcing risks in Central African countries (a relic from the US Dodd-Frank Act that focused on so-called ‘conflict minerals’), rather than thinking more expansively about potential supply chain risks and taking a global approach.

Despite being key suppliers to a major automotive brand and significant multinational corporations in their own right, most of the suppliers’ policies that we reviewed demonstrated only a basic understanding of what responsible minerals sourcing actually is. And, if a policy – arguably the easiest part of a management system – is insufficient, what else is lacking in a company’s approach to responsible sourcing when you scratch below the surface?

With the arrival of mandatory human rights due diligence requirements such as the EU corporate sustainability directive, the German supply chain due diligence act and the Norwegian Transparency Act, companies need to be thinking quickly and carefully about their approaches to responsible sourcing. Not all companies will be directly implicated by these regulations, however, these legal requirements show a direction of travel for mandatory due diligence and it is likely that similar laws will follow in other jurisdictions.

Kumi’s responsible sourcing advisory services

In order to achieve supply chain due diligence compliance, companies need to have management systems in place that cascade responsible sourcing expectations down the supply chain and sufficiently identify and manage ESG risks.

There are many ways that we can support companies on responsible sourcing. We have selected a few services that we can offer, related to contents of this article, but we welcome a discussion with you to work out how we can best tailor our services to your needs:

- Gap analysis: We can deploy our Responsible Sourcing Diagnostic to assess your company’s approaches to responsible sourcing to identify existing strengths and gaps. The main outputs of our Diagnostic are a report containing findings and targeted recommendations and a series of workshops to build company capacity. Examples of our Responsible Sourcing Diagnostic include our work with OneMed and a clean mobility materials company.

- Management systems: We can work with you to develop and draft relevant documentation, policies and processes to ensure that your responsible sourcing systems are meeting good practice recommendations. This includes defining management roles and accountabilities for responsible sourcing. An example of this is our support to a European platinum and palladium refiner.

- Capacity building: We can build your internal capacity on responsible sourcing through a series of workshops and discussions. These trainings will provide Kumi’s insights on the practical implications of regulatory requirements and what a responsible sourcing management system should look like. An example of this is the series of workshops that we undertook to build a Fortune 500 company’s capacity on responsible sourcing.

Kumi’s RMI analysis methodology

Kumi’s responsible sourcing consultants assessed the conflict minerals policies of companies that are members of the Responsible Minerals Initiative (RMI) in 2017 and 2021. For these analyses, we set three tests to define whether a company is aligned with the recommendations of the OECD Minerals Guidance, which forms the basis of several regulatory and industry requirements for responsible minerals sourcing:

- Is the policy limited to minerals sourced from a defined geographical area (e.g. the Democratic Republic of Congo and adjoining countries) or is it global in scope, as per the OECD Minerals Guidance? The US Dodd-Frank Act’s scope is focused on risk in Central African countries, however it is good practice for companies’ responsible minerals programmes to be global in nature and not limited to a specific region. Many companies continue to just focus on the requirements of the Dodd-Frank Act, rather than thinking more expansively about potential supply chain risks.

- Does the policy reference the risks set out in Annex II of the OECD Minerals Guidance? The risks included in Annex II are recognised as the most salient risks impacting the minerals industry. It is good practice to make reference to these risks at policy level (or at least refer back to Annex II of the Guidance).

- Does the policy state that the company expects suppliers to comply with its policy? It is important responsible sourcing expectations are effectively cascaded down the supply chain.