Everything, everywhere, all at once? Preparing for the EU Batteries Regulation

In Kumi’s work developing the implementation guidelines for the EU Batteries Regulation (EUBR) on behalf of the European Commission, we have found that many businesses have questions about compliance in anticipation of the August 2025 deadline.

As with other due diligence regulations, one of the most common questions businesses ask is, “Do we have to do everything, everywhere, all at once?” No, you don’t. However, there are some key terms and requirements that companies placing a battery on the EU market need to understand and meet. So, in this first of our three-part series on EUBR, we will share answers to some of the common questions we’ve received to help you prepare for the regulation’s arrival.

The need for regulation

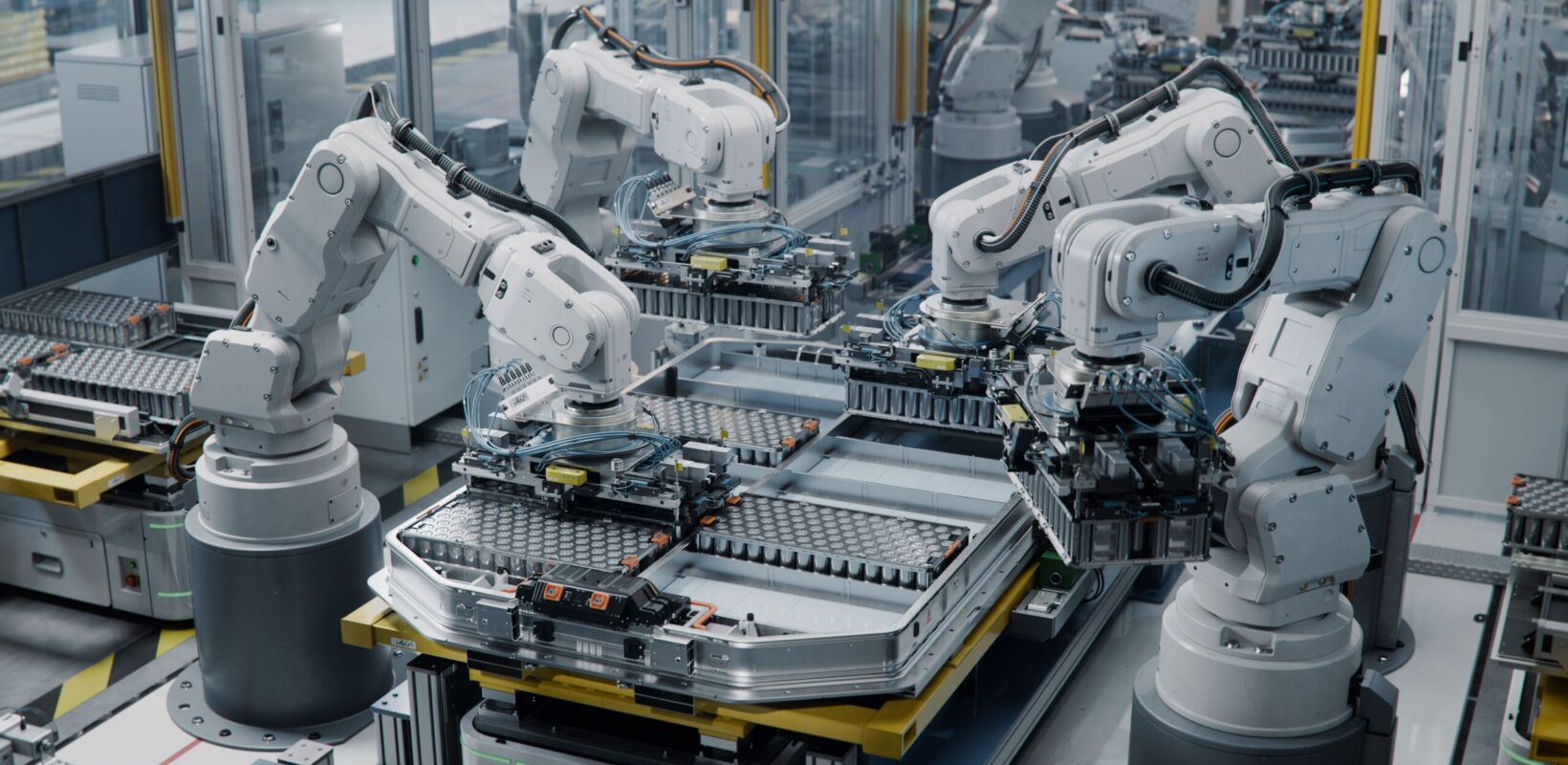

The batteries that power our daily lives—whether in smartphones, electric vehicles, or renewable energy systems—represent a complex chain of interconnected impacts, from the deep mines of the Congo to the recycling plants of Europe.

The global demand for batteries is expected to increase 14-fold by 2030, with the EU accounting for approximately 17% of that demand. This surge is driven by the expansion of electric vehicles, renewable energy storage, and the proliferation of portable electronics. However, this growth is not without significant environmental and social consequences.

Battery production requires vast quantities of critical raw materials like lithium, cobalt, and nickel. The extraction of these materials, often from countries with limited environmental protections, can lead to deforestation, water pollution, and biodiversity loss. It can also have a profound human impact, with a high prevalence of child labour and unsafe working conditions in some supply chains.

The regulation of batteries in the European Union has evolved significantly over the past two decades. The initial framework, the Batteries Directive 2006/66/EC, mainly focused on controlling hazardous substances and improving the collection and recycling of batteries. However, as technology and materials changed and the market demand for batteries grew, these regulations needed to be revised to address new materials’ more complex environmental and social challenges.

In response, the new European Union Batteries Regulation (EUBR) was officially adopted in August 2023. It integrates due diligence requirements in human rights, environmental protection, and the circular economy. The EUBR has marked a significant shift towards lifecycle management, covering everything from raw material sourcing to end-of-life battery recycling and traceability requirements. The regulation also uses a system of notified bodies to assess and certify the conformity of batteries with the regulation’s requirements. This is intended to ensure that economic operators can sell only compliant batteries in the EU market. But the clock is ticking. Companies have until August 2025, when some obligations begin, to align their practices with the new regulation. So, let’s look at some of the common questions companies have been asking us as they prepare, starting with the basics…

1. The battery

A common question is, “What defines a battery?” followed by, “How is it introduced to the EU market under the EUBR?” This second point is important as it covers some key terms in the EUBR, such as “placing on the market” and “putting into service,” with obligations under the regulation for those businesses that do so.

What is a ‘battery’?

In the EUBR, a battery is “any device containing one or more electrochemical cells, intended to store electrical energy”. This definition covers a wide range of battery types, including:

- Lithium-ion batteries

- Lead-acid batteries

- Nickel-metal hydride batteries

- Nickel-cadmium batteries

- Alkaline batteries

It’s also important to note what devices are not considered batteries, such as capacitors, fuel cells and solar cells. A battery is the final, ready-to-use product in its intended end use. Battery cells or modules are not considered the final battery.

What does it mean to place a battery on the European market?

In the EUBR, “placing a battery on the European market” refers to the first time a battery is made available for distribution, consumption, or use “on the market” within the European Union. This can involve manufacturers, importers, and distributors. Regardless of whether it’s newly produced or imported from outside the European Union when a battery is offered for sale in the EU market for the first time (for free or for a charge), it is “placed on the market”. Let’s look at two examples:

- Manufacturer: A battery manufacturer based in Germany produces batteries and sells them to a distributor in France. As this is the first time the manufacturer sells batteries to the distributor, this is considered “placing on the market.”

- Importer: An importer in Spain brings batteries manufactured in China into the EU. The importer’s first sale or distribution of these batteries within the EU constitutes “placing them on the market”.

Is this the same as “putting [the battery] into service”?

No. Placing a battery on the market differs from “putting it into service”. Putting into service takes place at the moment of first battery use within the European Union by an economic operator for the purposes for which [the battery] was intended.

There are limitations on the need to demonstrate compliance of products when a battery is put into service and (if applicable) that they are correctly installed, maintained and used for the intended purpose, including batteries that had not been placed on the market before being put into service. For example, this is applied to products manufactured for “own use”, which is within the scope of the applicable European Union legislation or used only after an assembly, an installation, or other manipulation has been carried out.

Here are some examples of when a battery product is considered “put into service”:

- Electric Vehicles: When a battery is installed in an electric vehicle and used for the first time in the EU, it is considered to have been “put into service.”

- Consumer Electronics: If a battery is installed in a consumer electronic device, such as a smartphone, and that device is turned on for the first time within the EU, the battery has been “put into service.”

2. The economic operator

Next, let’s look at the role of companies involved in the battery supply chain (economic operators) and what they must do under the EUBR.

Am I an “economic operator” in the EUBR?

If your business is placing a battery on the EU market, you are an economic operator under the Regulation. This can include many companies, including manufacturers, distributors, importers, etc. Responsibilities include compliance with EU standards and regulatory requirements, maintaining documentation, providing information, and cooperating with other economic operators and market surveillance (by regulatory authorities).

Do I have to conduct due diligence in my supply chain?

If you are an economic operator as defined in the regulation, yes, you do. Before placing your products on the market, you must ensure they comply with all applicable legal, safety, and environmental standards. This means conducting thorough risk assessments of your supply chains. It also includes evaluating the sources of raw materials, the environmental impact of production processes, and potential risks associated with using and disposing of batteries.

This due diligence must be done by an economic operator placing a battery on the EU market for the first time or putting it into service for the first time. As noted earlier, a “battery” is the final, ready-to-use product in its intended end use. Battery cells or modules are not considered the final battery.

For example, a company that assembled the final battery without producing the different components is still considered a battery manufacturer. So, whoever finishes the battery and sells it is responsible for conducting due diligence.

The EUBR sets out due diligence obligations, including public reporting, third-party verification and a verification report by notified bodies. These requirements come into force from 18 August, 2025. Due diligence must be conducted if, as an economic operator, the following applies to you;

- Your annual worldwide turnover (not specific to batteries) exceeds EUR 40 million in the prior two years, either on your own or on a consolidated basis if your company is part of a group consisting of parent and subsidiaries.

- You are placing batteries on the EU market for the first time or are putting them into service for the first time (re-used/purposed batteries are not in scope).

- The battery contains one of four raw materials in their (electrochemically) ‘active form’ and/or, if used as an electrolyte material – nickel, lithium, cobalt, and graphite.

Even if you are not an economic operator with obligations under the Regulation, you will likely be in the supply chain of a company that is, so you should be ready to support your downstream customers’ due diligence activity.

As an economic operator, what do I need to do?

As a first step, you should determine what batteries you will need to conduct due diligence on. At the same time you’ll be engaging with your suppliers and direct business customers to check what they are doing about their own due diligence. This includes identifying which batteries they are responsible for. The most important point is demonstrating that due diligence has been done in line with the regulation. This means risk-based due diligence covering the entire upstream supply chain, from mining, up until and including battery material production and that of the electrolyte. Remember, whether you are the economic operator or not, EU and national authorities will watch out for adequate due diligence, so it will be important to work closely with your suppliers and business customers to agree on responsibilities.

What about my upstream supply chain?

As an economic operator, you must assess and monitor your suppliers to ensure that all materials and components used in battery production comply with EU standards. This involves verifying suppliers’ adherence to environmental standards, ethical labour practices, and quality standards. Let’s look at what that means for the raw material supply chain:

- Mining, processing and trading of the four raw materials specified in the EUBR (up to and including the production of cathode/anode active materials and the electrolyte): Economic operators will need to ensure full risk management (risk assessment, risk response, grievance mechanism, etc.) of the supply chain at all stages from raw material production through to the production of cathode/anode active materials and the electrolyte. Economic operators should request information from their suppliers about risk performance and management and seek to improve that performance wherever needed.

- The entire supply chain for the four raw materials (up and downstream): A “system of control and transparency” will be needed to allow the identification of suppliers up to raw materials extraction (mining/recycling). Therefore, economic operators should ensure that all suppliers share chain of custody information. Further details on interpreting these requirements and the needed information flows will be included in Kumi’s proposal on the draft guidelines.

3. Compliance

Finally, let’s examine how this all fits together by understanding the role of a “notified body” in ensuring that a battery product complies with the EUBR before it is placed on the market.

I manufacture a battery product and want to place it on the EU market. How do I demonstrate that my product meets the requirements?

If you are a manufacturer, you must engage with a “notified body” to ensure that your products meet the requirements of EU regulations . A “notified body” is an independent conformity assessment organisation designated by an EU member state to evaluate and approve that a battery product complies with relevant EU directives and regulations when placed on the market. As an example, a battery manufacturer implements the regulation’s different product and declaration requirements, conducts due diligence, and ensures all necessary documentation is in place. The manufacturer then engages a notified body to perform a conformity assessment. The notified body reviews the manufacturer’s due diligence processes* alongside the remaining requirements and certifies that the battery meets EU standards. With this certificate of conformity, the manufacturer can now legally place the battery on the market, confident that it complies with all regulatory requirements. (*approval of the due diligence process by the notified body is not a prerequisite for placing the battery on the market).

Notified bodies

The European Commission will publish a list of notified bodies (i.e. bodies approved to conduct third-party verification). Outside the EU, companies may also use these bodies (it is up to the bodies to ensure they have the required geographic coverage and expertise), but notifying authorities of EU Member States may restrict bodies if they are not qualified to cover non-EU geographies. The EUBR is clear that notified bodies should avoid any conflict of interest, particularly with consulting services.

August 2025 is coming…

The EUBR represents a major step toward ensuring that the batteries powering our green transition are produced and managed responsibly, ethically, and sustainably. As we’ve outlined, the EUBR’s scope is broad, and the timeline for compliance is pressing. Businesses must navigate a complex landscape of due diligence, environmental standards, and human rights considerations across the supply chain. However, this challenge also presents an opportunity to lead in the increasingly regulated European market.

While due diligence doesn’t mean doing everything, everywhere, all at once, the August 2025 deadline is fast approaching. Now is the time to assess your supply chain practices, engage with your suppliers, and ensure that your due diligence processes are robust and transparent.

Our work on the EUBR guidelines continues, and we will soon submit our proposals to the Commission. In the meantime, stay tuned for part two of our EUBR series, where we will examine how companies build capacity to respond to the EUBR and support suppliers upstream to provide transparency.

Don’t forget to subscribe to our newsletter for the latest updates on the EUBR, and contact our team for help navigating the EUBR and what it means for your business.